43 present value of coupon bond calculator

In addition to evaluating the expected cash flows from individual For example, if a bond has a par value of $1,000 and a coupon rate of 8%, then you will receive annual coupon (interest) payments of $80 ... & Step 3: Calculate the present value of the expected cash flows (step-1) using the appropriate interest rate. India s leading stock broking company provides online share trading platform. It s an online ... Bond Yield Calculator | Calculate Bond Returns coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually. Determine the years to maturity

Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Present value of coupon bond calculator

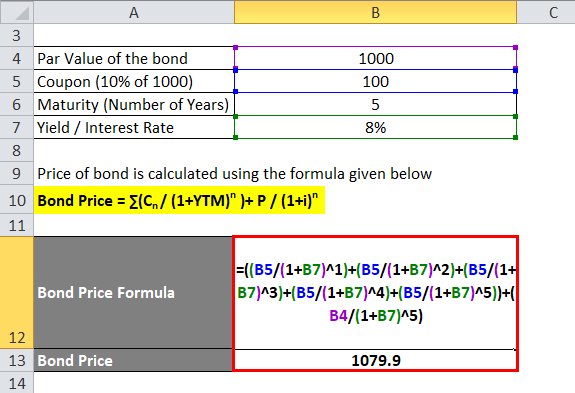

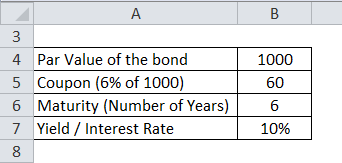

Bond Price Calculator - Present Value of Future Cashflows - DQYDJ You will want to start by creating a spreadsheet such as the above. nclude the parameters we have in the calculator on this page - Face Value, Coupon Rate, Market Interest Rate (or Discount Rate ), Years to Maturity and Payments per Year. Then you should use the 'PV' formula (use ';' to separate inputs in OpenOffice, use ',' in Excel). How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is Bond Present Value Calculator - UltimateCalculators.com Use the present value of a bond calculator below to solve the formula. Present Value of a Bond Definition Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Variables PV of Bond=Current market value of bond

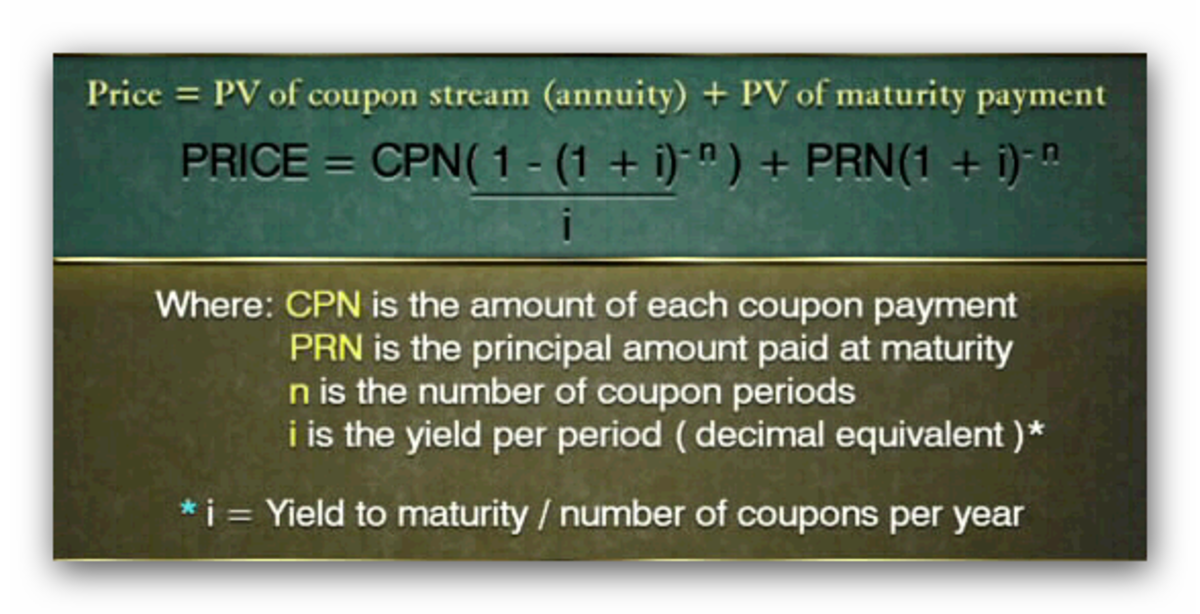

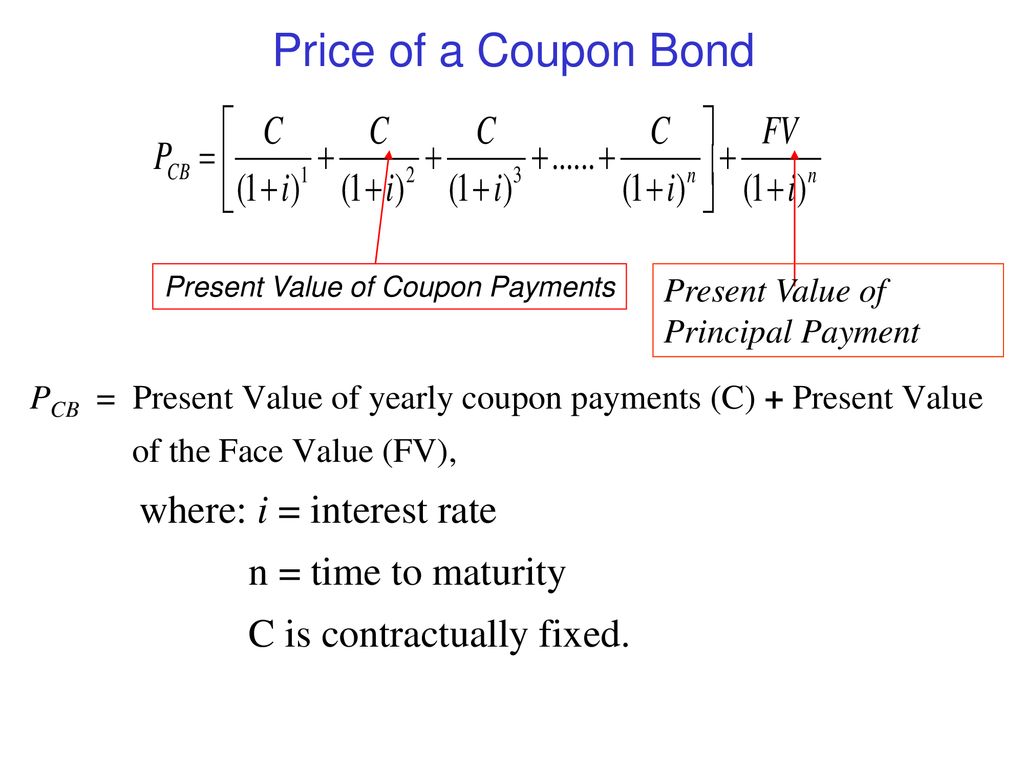

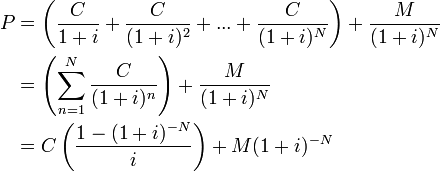

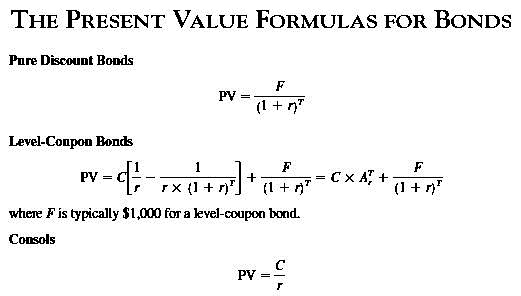

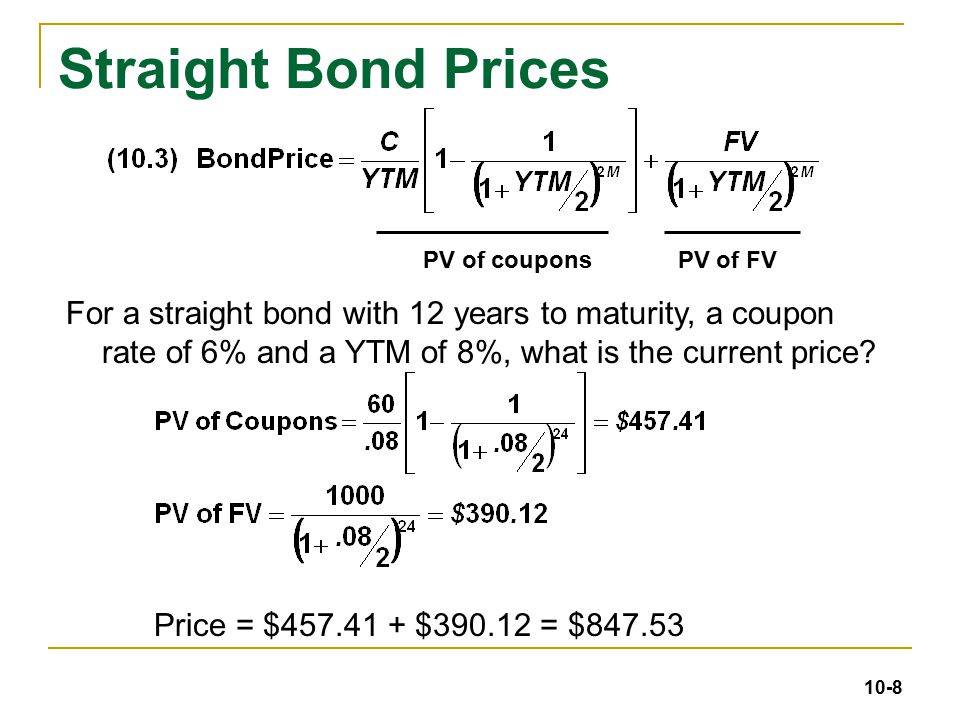

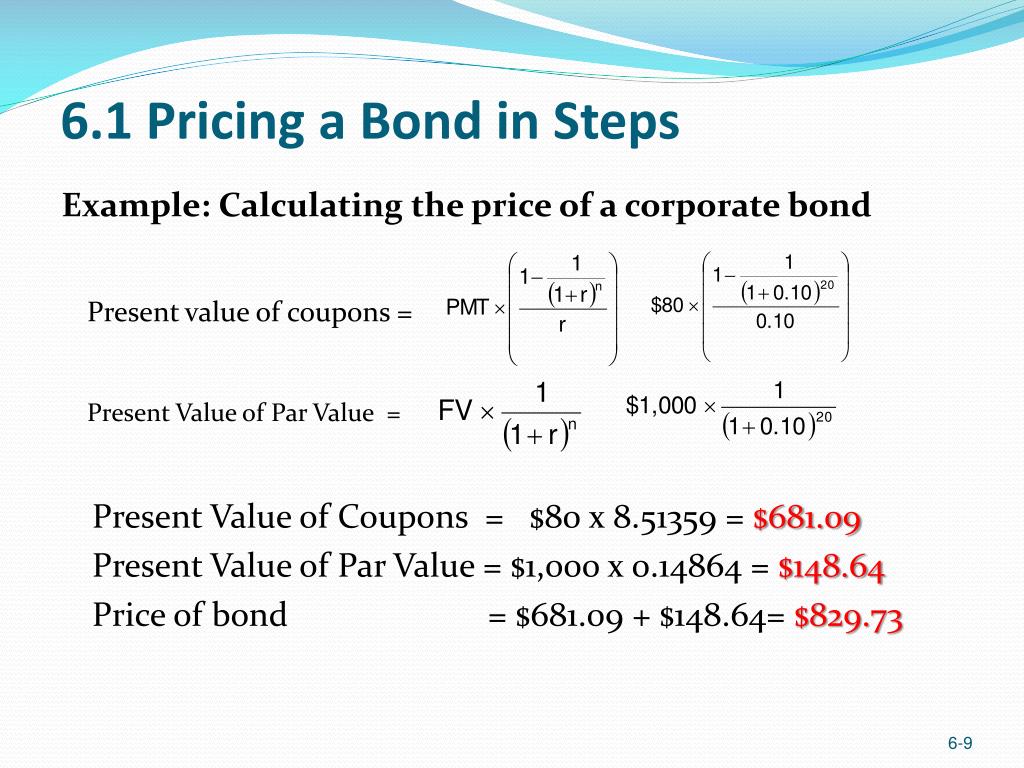

Present value of coupon bond calculator. Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) If I buy an EE - qhlzg.fodpik.pl The BEY is calculated as follows: Bond Equivalent Yield = Face Value−Purchase Price / Purchase Price × 365/d. Jul 27, 2022 · Calculation of Bonds Value. The valuation of a bond is based on three factors. These are coupon rate, maturity date, and the current price. Based on these factors, the value of the bond can be easily Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. However, do note that a Debt Fund portfolio will include multiple Second, calculate the present value. Third, sum the present value to know the intrinsic value. If you bought a 10-year bond paying 4% coupon with a face value of S$100, you will receive semi-annual interest of: (S$100 x 0.04 /2) = S$2. ... How to measure: Use the SGS Bond Calculator to calculate the yield to maturity of your bond. Calculating T ... Formula to - whio.mptpoland.pl Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity.The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is basically. Calculate the Value of Your Paper Savings Bond(s) - TreasuryDirect The Savings Bond Calculator WILL: Calculate the value of a paper bond based on the series, denomination, and issue date entered. (To calculate a value, you don't need to enter a serial number. However, if you plan to save an inventory of bonds, you may want to enter serial numbers.) Store savings bond information you enter so you can view or ...

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Bond Price Calculator F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity Present - ffv.mptpoland.pl Use the present value of a bond calculator below to solve the formula.. 2021. 10. 23. · To determine the discount rate for monthly periods with semi-annual compounding, set k=2 and p=12. Daily Compounding (p=365 or p=360) ... The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: ... Coupon Payment | Definition, Formula, Calculator & Example Coupon payment for a period can be calculated using the following formula: Coupon Payment = F ×. c. n. Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator.

Individual - Savings Bond Calculator for Paper Bonds - TreasuryDirect Find out what your paper savings bonds are worth with our online Calculator. The Calculator will price paper bonds of these series: EE, E, I, and savings notes. Other features include current interest rate, next accrual date, final maturity date, and year-to-date interest earned. Historical and future information also are available.

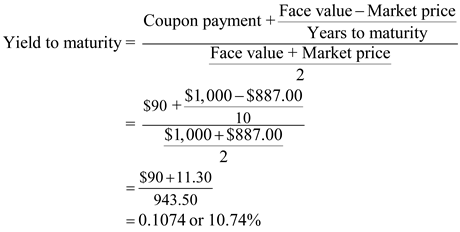

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Present Value of Future Money. Future Value (FV) Number of Periods (N) Interest Rate (I/Y) Results. Present Value: $558.39.

A zero-coupon - juhoo.bhdesign.fr Along with that different aspects of a single type of bond can be calculated with these calculators. FV - Face Value of the bond. PV - Present value of the bond. t - Number of years it takes the bond to reach maturity. Example: Assume that there is a bond on the market priced at $800 and that the bond comes with a face value of.

Bond maturity value calculator - kuvqza.mara-agd.pl Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond . F = Face value of the bond . R = Market. t = Number.

In either case, at - feb.piasekbarcik.pl May 1981 -. 3. Compute the bond value by multiplying the percentage price quote by the bond's par value. For example, if a bond is quoted at 110.0 and has a. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency.

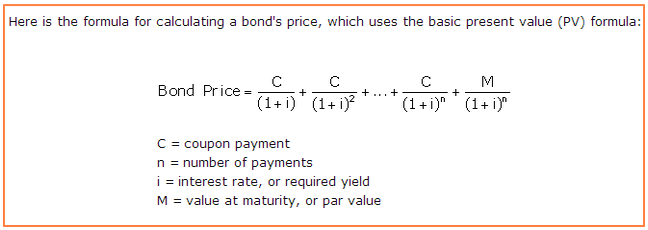

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =.

Present Value Coupon Bond Calculator - Bizim Konak How to Calculate Present Value of a Bond - Pediaa.Com. CODES (Just Now) The total present value of the bond can be represented as, Calculate Present value of a bond - Example: Following information is given with regard to the bond issue of ABC Company. Face value of the bond - $ 2000 Maturity period of the bond - 5 years Annual coupon ...

Bond Present Value Calculator - UltimateCalculators.com Use the present value of a bond calculator below to solve the formula. Present Value of a Bond Definition Present Value of a Bond is the value of a bond equal to the discounted remaining interest payments and the discounted redemption value of the bond certificate. Variables PV of Bond=Current market value of bond

How to Calculate Bond Price in Excel (4 Simple Ways) Method 1: Using Coupon Bond Price Formula to Calculate Bond Price Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is

Bond Price Calculator - Present Value of Future Cashflows - DQYDJ You will want to start by creating a spreadsheet such as the above. nclude the parameters we have in the calculator on this page - Face Value, Coupon Rate, Market Interest Rate (or Discount Rate ), Years to Maturity and Payments per Year. Then you should use the 'PV' formula (use ';' to separate inputs in OpenOffice, use ',' in Excel).

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "43 present value of coupon bond calculator"