44 coupon rate 10 year treasury

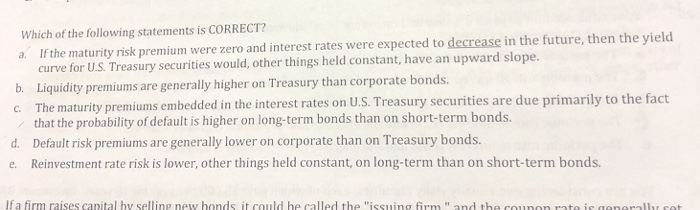

Treasury Notes — TreasuryDirect Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .) Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present. TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present TNC Treasury Yield Curve On-the-Run Par Yields, Monthly Average: 1986-Present ...

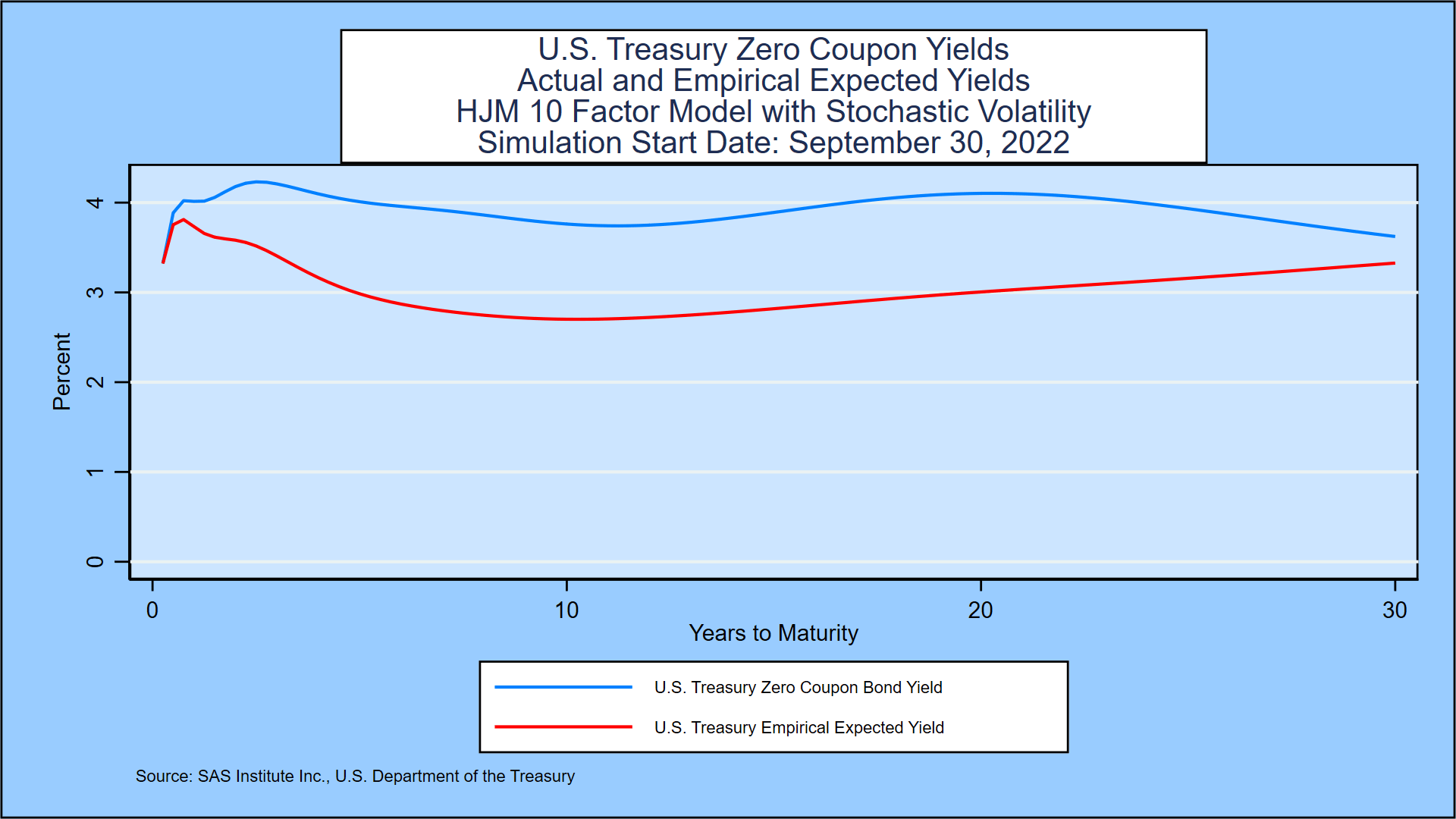

10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of September 30, 2022 is 3.83%. Show Recessions Download Historical Data Export Image

Coupon rate 10 year treasury

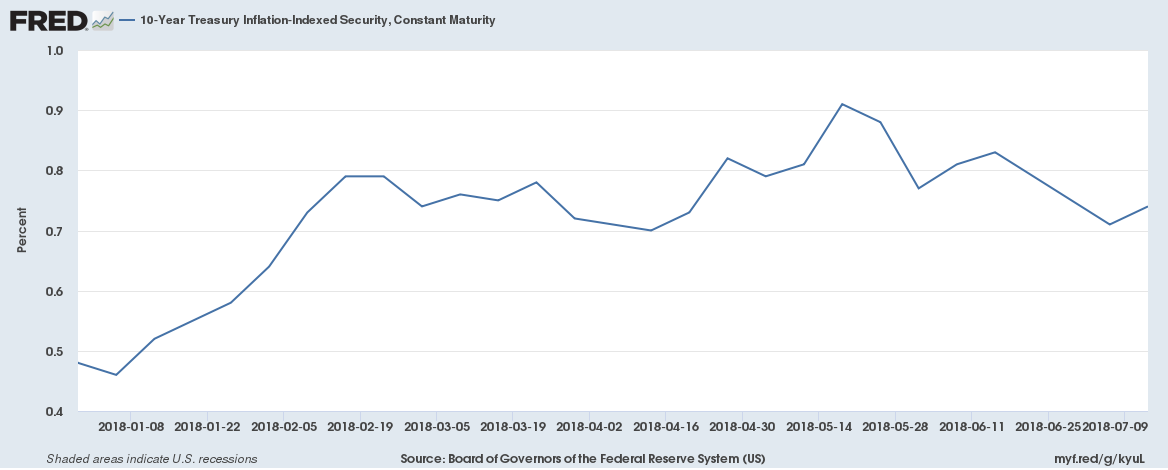

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Board of Governors of the Federal Reserve System (US), Fitted Yield on a 10 Year Zero Coupon Bond [THREEFY10], retrieved from FRED, Federal Reserve Bank of St. Louis; , September 27, 2022. RELEASE TABLES United States Rates & Bonds - Bloomberg Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 3.11: 3.28% +45 ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 3.05: ... Muni Bonds 10 Year Yield . 3.22%-4 +54 +208: Micro 10-Year Yield Quotes - CME Group 1 day ago · Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures.

Coupon rate 10 year treasury. Treasury yields rise as uncertainty over Fed rate policy spreads The yield on the benchmark 10-year Treasury was last higher by around 6 basis points at 3.681%. The policy-sensitive 2-year Treasury climbed 2 basis points to 4.121%. Yields and prices have an ... 10 Year Treasury Coupon Rate Announcement - bizimkonak.com 10-Year Treasury Note and How It Works - The Balance. CODES (1 days ago) WebIt's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the … Visit URL. Category: coupon codes Show All Coupons The 10-Year Treasury Yield Slips As Soft Economic Data Injects 'Hopium' The 10-year Treasury yield sharply dropped on Tuesday, highlighting market speculation about a so-called Fed pivot from aggressive interest rate hikes. Soft economic data including a tumble in US ... 10-Year Treasury Note and How It Works - The Balance 0.06% on the one-month Treasury bill 0.06% on the three-month bill 0.73% on the two-year Treasury note 1.52% on the 10-year note 1.93% on the 30-year Treasury bond 12 Frequently Asked Questions (FAQs) How can I buy a 10-year Treasury note? You can buy Treasury notes on the TreasuryDirect website in $100 increments.

US Treasury Bonds - Fidelity Structure: Coupon or no coupon/discount Investors in Treasury notes (which have shorter-term maturities, from 1 to 10 years) and Treasury bonds (which have maturities of up to 30 years) receive interest payments, known as coupons, on their investment. The coupon rate is fixed at the time of issuance and is paid every six months. October 2022 — TreasuryDirect Monthly Interest Rate Certification October 2022. In February of 1997, the Fiscal Assistant Secretary of the U.S. Department of the Treasury delegated to the Bureau of the Public Debt (now the Bureau of the Fiscal Service) the responsibility of providing interest rate certification to various agencies. The U.S. Department of Treasury certifies these rates for the month of October 2022. 10-Year Treasury Note Definition - Investopedia The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once... US 10-year T-Note Auction Coupon Rate | U.S. Treasury Bond - MacroMicro US 10-year Treasury Note Futures Price (R) 2022-02-18. 126.67. MM US Treasury Note Fundamental Index (L) 2022-01-25.60. Source. CME; ... Save US 10-year T-Note Auction Coupon Rate. The coupon rate is viewed as the fundamental costs of buying bonds. When auction coupon rate is low, demand for bonds could be huge, which leads to an increase in ...

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing September 24th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. Treasury makes full award of new 10-year bonds on strong demand Sep 14, 2022 · THE GOVERNMENT fully awarded the fresh Treasury bonds (T-bonds) it offered on Tuesday on strong demand for higher-yielding instruments amid expecta tions of more rate hikes in the United States.. The Bureau of the Treasury (BTr) raised P35 billion as planned via the fresh 10-year T-bonds it auctioned off on Tuesday, with total tenders reaching P99.311 … TMUBMUSD10Y | U.S. 10 Year Treasury Note Price & News - WSJ Sep 29, 2022 · TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today’s stock price from WSJ. TMUBMUSD03Y | U.S. 3 Year Treasury Note Overview | MarketWatch Oct 03, 2022 · Aggressive rally in U.S. government debt sends Treasury yields down by 10 to 15 basis points each, led by drop in 3-year rate; 10-year dips below 2.75% May. 24, 2022 at 10:09 a.m. ET by Vivien Lou ...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. ... What Is a 10-Year Treasury Note? A 10-year Treasury note is a ...

10 Year Treasury Rate - YCharts The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury ...

ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news.

Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example. Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63%. The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

10-year coupon rate drops - Manila Bulletin The coupon rate of the new 10-year Treasury bonds fetched at 6.75 percent, lower than the 7.75 percent when same instrument was sold in June 2022. However, the coupon rate was slightly higher than the 6.600 percent fetched in the secondary market, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates published on the Philippine ...

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes When setting the Federal Funds Rate, the Federal Reserve takes into account the current 10-year Treasury rate of return. The yield on the 10-Year Note is the most commonly used Risk-Free Rate for calculating a company's Weighted Average Cost of Capital (WACC) and performing Discounted Cash Flow (DCF) Analysis. Investing in Treasury Notes

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Open 3.636% Day Range 3.582 - 3.652 52 Week Range 1.341 - 4.010 Price 93 1/32 Change 26/32 Change Percent 0.88% Coupon Rate 2.750% Maturity Aug 15, 2032 Performance Change in Basis Points Yield...

10-Year High Quality Market (HQM) Corporate Bond Spot Rate Sep 10, 2022 · Graph and download economic data for 10-Year High Quality Market (HQM) Corporate Bond Spot Rate (HQMCB10YR) from Jan 1984 to Aug 2022 about 10-year, bonds, corporate, interest rate, interest, rate, and USA.

Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity ... View a 10-year yield estimated from the average yields of a variety of Treasury securities with different maturities derived from the Treasury yield curve. Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis

US 10 Year Treasury Yield - Investing.com Get our 10 year Treasury Bond Note overview with live and historical data. The yield on a 10 yr treasury bill represents the return an investor will receive by holding the bond for 10 years.

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of September 30, 2022 is 3.79%.

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 3.615% Yield Day High 3.651% Yield Day Low 3.574% Yield Prev Close 3.651% Price 93.0469 Price Change +0.4531 Price Change % +0.4922% Price Prev Close 92.5938 Price Day High 93.2031 Price...

How Is the Interest Rate on a Treasury Bond Determined? - Investopedia If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the...

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month

Micro 10-Year Yield Quotes - CME Group 1 day ago · Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures.

United States Rates & Bonds - Bloomberg Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month . 0.00: 3.11: 3.28% +45 ... Rate Current 1 Year Prior; FDFD:IND . Fed Funds Rate . 3.05: ... Muni Bonds 10 Year Yield . 3.22%-4 +54 +208:

Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Board of Governors of the Federal Reserve System (US), Fitted Yield on a 10 Year Zero Coupon Bond [THREEFY10], retrieved from FRED, Federal Reserve Bank of St. Louis; , September 27, 2022. RELEASE TABLES

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

/Clipboard01-f94f4011fb31474abff28b8c773cfe69.jpg)

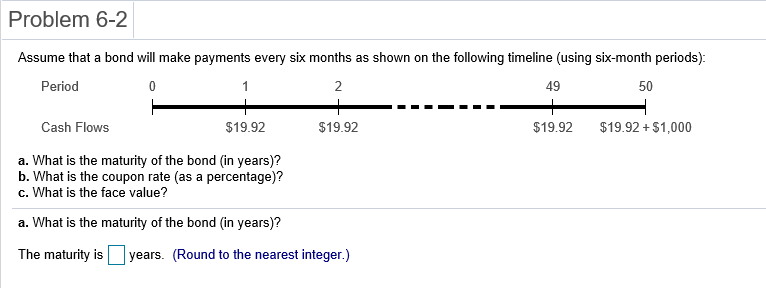

Post a Comment for "44 coupon rate 10 year treasury"