38 coupon vs interest rate

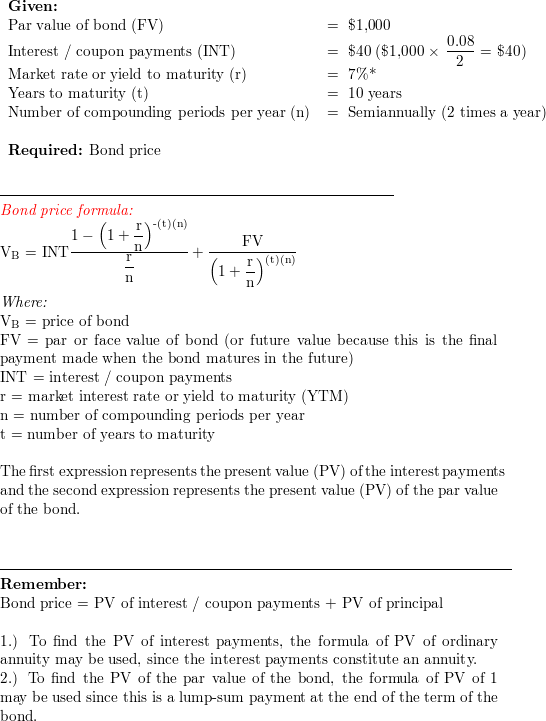

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Interest Rate Swaps Explained – Definition & Example May 02, 2011 · How Interest Rate Swaps Work. Generally, the two parties in an interest rate swap are trading a fixed-rate and variable-interest rate. For example, one company may have a bond that pays the London Interbank Offered Rate (LIBOR), while the other party holds a bond that provides a fixed payment of 5%. If the LIBOR is expected to stay around 3% ...

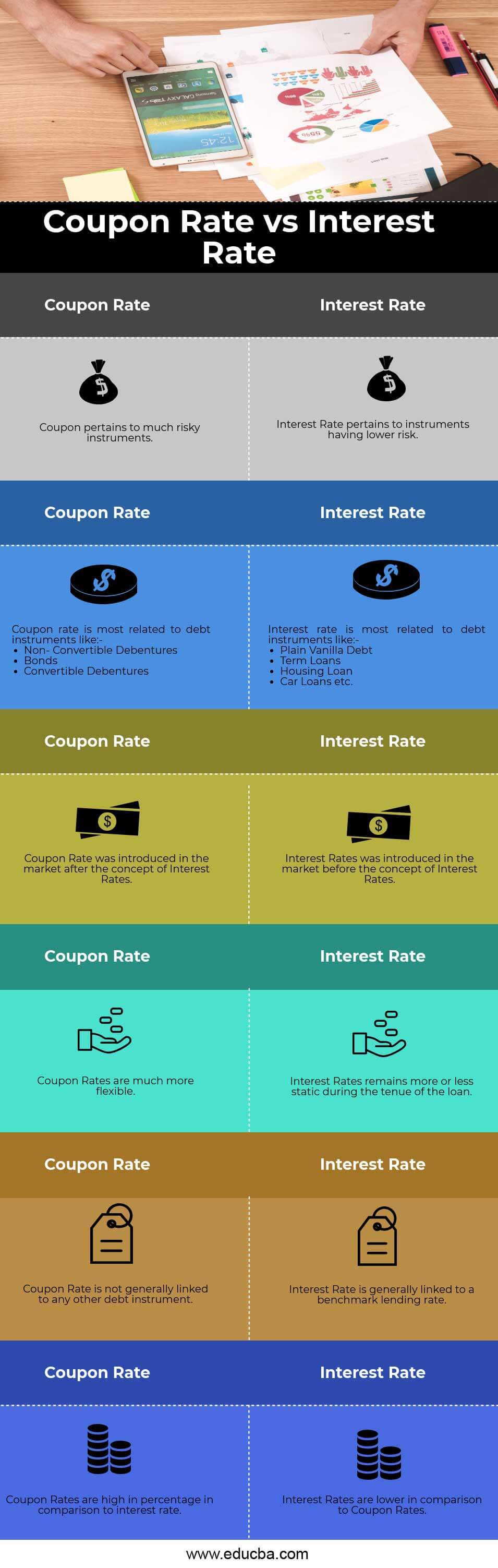

Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA Key differences between Coupon Rate vs Interest Rate. Let us discuss some of the major differences between Coupon Rate vs Interest Rate : The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business ...

Coupon vs interest rate

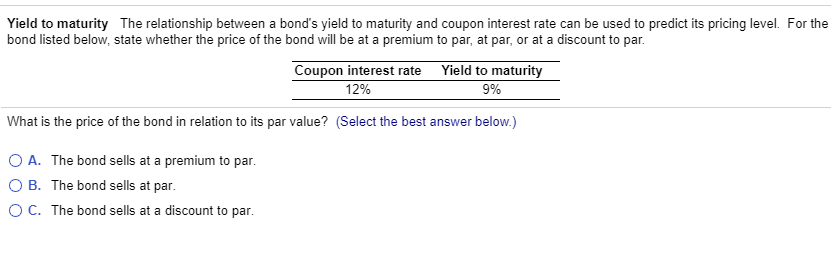

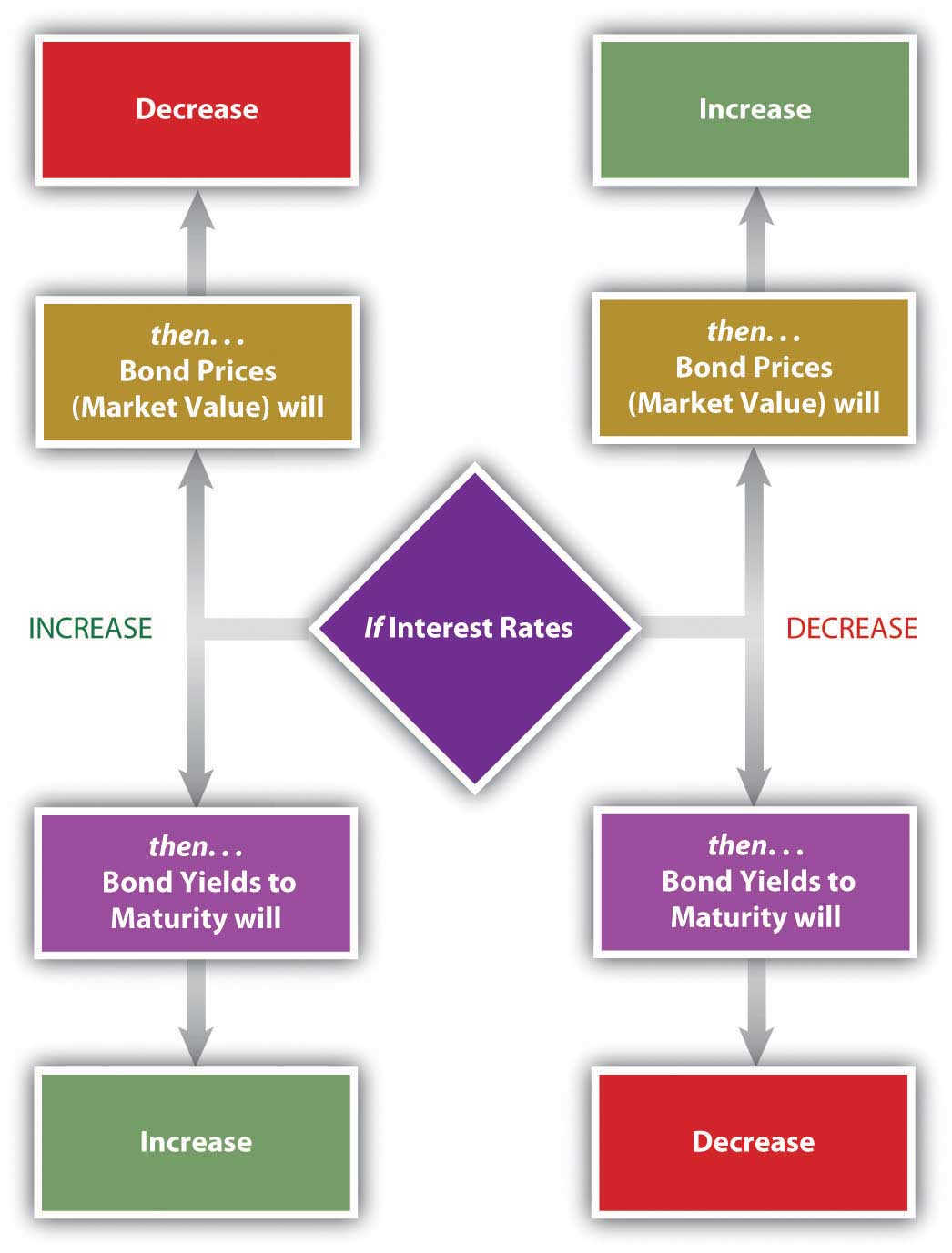

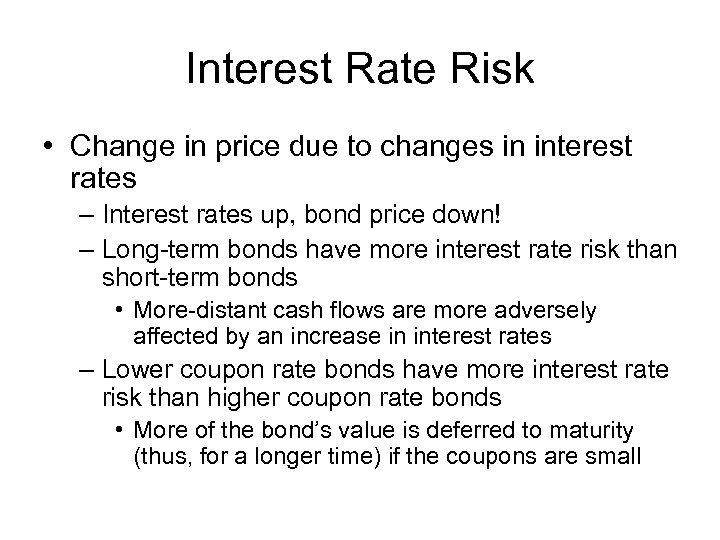

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... A single discount rate applies to all as-yet-unearned interest payments ... Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

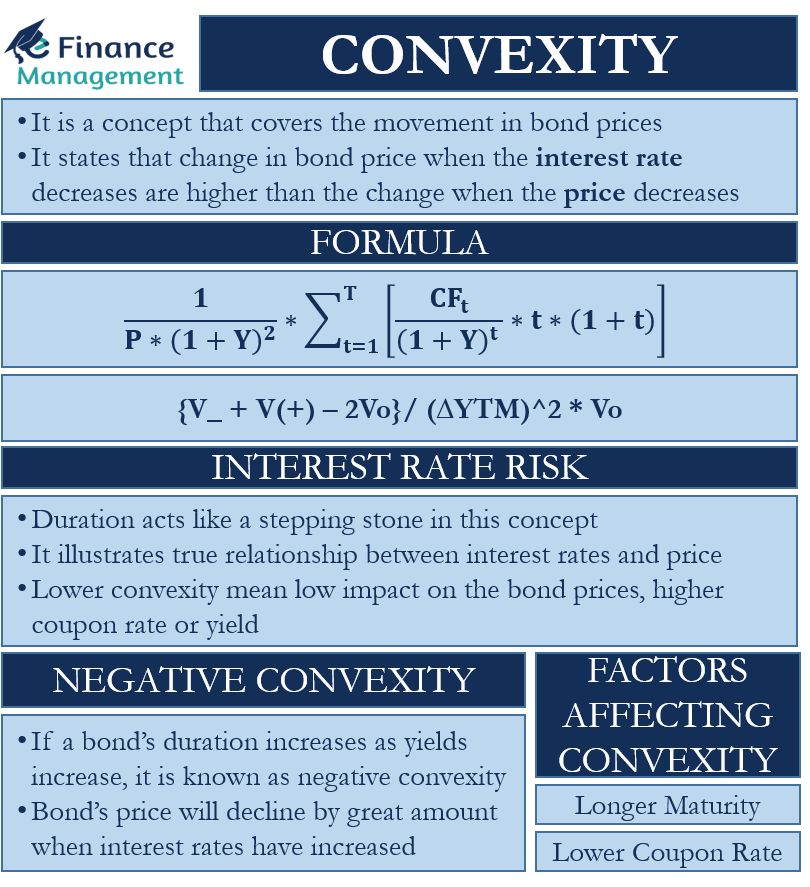

Coupon vs interest rate. Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond duration is also a measure of a bond's sensitivity to interest rate changes. Modified duration is the estimate of the price change of the bond for a 1% move in interest rates. However, the duration is only a linear approximation. Specifically, the duration is the first derivative of the bond's price as it relates to interest rate changes. Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield of a bond changes with a change in the interest rate in the economy, but the coupon rate does not have the effect of the interest rate. Recommended Articles. This has been a guide to the Coupon vs. Yield. Here we discuss the top differences between coupon rate and yield to maturity along with infographics and a comparison table.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less than the face amount of a bond, the current yield ... Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in mid ...

Difference Between Coupon Rate and Interest Rate Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender. Summary: Coupon Rate vs Interest Rate. Coupon rate of a fixed term security such as bond is the amount of yield paid annually that expresses as a percentage of the par value of ... Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Discover the difference between coupon rate vs. interest rate and identify how to calculate coupon rate using the coupon rate formula. Updated: 04/08/2022 Table of Contents Learn About Coupon Interest Rates | Chegg.com The coupon interest rate is visualized in percentage form. The coupon rate is calculated by dividing annual coupon payments with the face value of the bond. To visualize in the percentage form, this value is multiplied by 100. With the help of the following example, one can easily understand the concept of coupon rates. Coupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Individual - Treasury Notes: Rates & Terms 3.99%. 4.25%. 102.106357. Above par price required to equate to 3.99% yield. Sometimes when you buy a Note, you are charged accrued interest, which is the interest the security earned in the current interest period before you took possession of the security. If you are charged accrued interest, we pay it back to you as part of your next ...

Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face ...

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

What is difference between coupon rate and interest rate? The coupon rate is calculated on the face value of the bond which is being invested. The interest rate is calculated considering on the basis of the riskiness of lending the amount to the borrower. If the investor purchases a bond of 10 years, of a face value of $1,000 and a coupon rate of 10 percent then the bond purchaser gets $100 every year ...

The Best 5-Year CDs Offer Good Rates. But They're Not Good Enough to ... Fixed interest rate can be less valuable in a rising rate environment Withdrawal penalty if you take money out before maturity 5-Year CDs Compared to 1-Year and 3-Year CD Rates

How Does Credit Card Interest Work? - Forbes Advisor Most credit card companies will calculate credit card interest daily based on the current balance on your card. To calculate this daily interest rate yourself, divide your APR by 365 and then ...

Yield vs. Interest Rate: What's the Difference? - Investopedia Dec 17, 2021 · If the nominal rate is 4% and inflation is 2%, the real interest rate will be 2% (4% – 2% = 2%). When inflation rises, it can push the real rate into the negative.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ...

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Coupon Rate vs. Interest Rate - Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors' funds for a certain period. read more, which is being invested.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds. Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. ... A single discount rate applies to all as-yet-unearned interest payments ...

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "38 coupon vs interest rate"