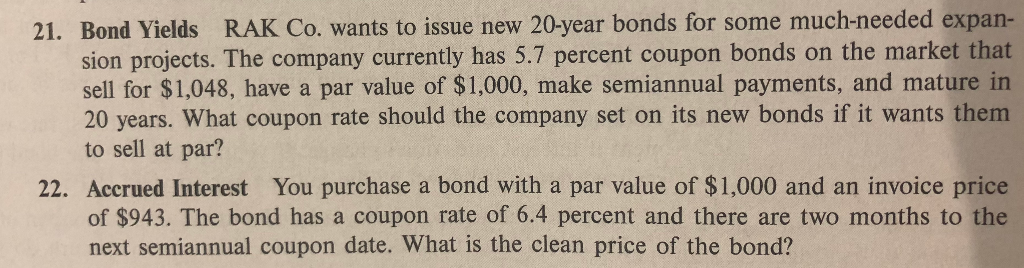

41 what coupon rate should the company set on its new bonds if it wants them to sell at par

Finance 300 Exam 2 Flashcards | Quizlet Bonner Metals wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 8.5 percent bonds on the market that sell for $959, make semiannual payments, and mature in 16 years. What should the coupon rate be on the new bonds if the firm wants to sell them at par? A) 8.75 percent B) 9.23 percent C) 8.41 percent Solved > 111.Jeffries, Inc. has 6 percent coupon bonds:1249983 ... MLK, Inc. wants to issue new 15-year bonds for some much-needed expansion projects. The company currently has 6.5 percent coupon bonds on the market that sell for $975.00, make semiannual payments, and mature in 15 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? A. 3.38 percent. B. 6.37 percent

Chamberlain Co. wants to issue new 20-year bonds for some - SolutionInn Chamberlain Co. wants to issue new 20-year bonds for some Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years.

What coupon rate should the company set on its new bonds if it wants them to sell at par

BDJ Co. - Coupon Rate Bonds - BrainMass 19. BDJ Co..doc Solution Summary This solution is comprised of a detailed explanation to answer what coupon rate should the company set on its new bonds if it wants them to sell at par. $2.49 Add Solution to Cart (Solved) - Question RAK Co. wants to issue new 20-year bonds for some ... RAK Co. wants to issue new ... Solved - Pembroke Co. wants to issue new 20-Answer Pembroke Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,063, make semiannual payments, and mature in 20 years. What Coupon Rate. should the company set on its new bonds if it wants them to sell at par?

What coupon rate should the company set on its new bonds if it wants them to sell at par. Chamberlain Co. wants to issue new 16-year bonds for some much-needed ... Chamberlain Co. wants to issue new 16-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,035, make semiannual payments, and mature in 16 years.What coupon rate should the company set on its new bonds if it wants them to sell at par? Answer in Finance for rim #9185 - assignmentexpert.com What coupon rate should the company set on its new bonds if it wants them to sell at par? 6.25 percent 6.37 percent 6.50 percent 6.67 percent 6.75 percent Expert's answer Coupon rate is annual payout as a percentage of the bond's par value. Compounding = semi annually Par Value = 1000 Market Rate = 6.5 Market Price = 972.78 N = 40 (Solved) - What coupon rate should the company set on its new bonds if ... Coupon rate should be equal ... 7.6-7.7 Bonds: Inflation, Interest Rates,and Determinants of ... - Quizlet If Connor Co. wants the bonds to sell at par, they should set the coupon rate equal to the required return. • The required return can be found by finding the YTM. • N = 28 (semiannual periods) • FV = 1,000 • PMT = 1000*(0.116/2) (semiannual payment) • CPT I/Y = 5.70% (semiannual rate) • YTM = 2*5.70% = 11.40% (annual rate)

Seether co wants to issue new 20 year bonds for some What coupon rate should the company set on its new bonds if it wants them to sell at par? →8.75% 4.38% 8.65% 8.85% 8.00% The company should set the coupon rate on its new bonds equal to the required return. The required return can be observed in the market by finding the YTM on outstanding bonds of the company. Solved Bond Yields Chamberlain Co. wants to issue new - Chegg What coupon rate should the company set on its new bonds if it wants them to sell at par? It would help to know how to; Question: Bond Yields Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and ... Quiz 6 PDF - 1.BDJ Co. wants to issue new 21-year bonds for... Coupon rate 7 .8 2 ± 1 .0 % % Explanation: The company should set the coupon rate on its new bonds equal to the required return of the existing bond. The required return can be observed in the market by finding the YTM on outstanding bonds of the company. So, the YTM on the bonds currently sold in the market is: P R%,42) + $1,000(PVIF R%,42) Using a spreadsheet, financial calculator, or trial and error, we find: R = 3. [Solved] Co. wants to issue new 19- year bonds for some necessary ... Co. wants to issue new 19- year bonds for some necessary expansion. projects. the company currently has 8.2% coupon on the market that sell at 1148.09, make semiannual payments, and mature in 19 years. what coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1000.

Coccia Co. wants to issue new 20-year bonds for some much-needed ... BDJ Co. wants to issue new 25-year bonds for some much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Bond Yields Giles Co. wants to issue new 20-year bonds - SolutionInn Bond Yields Giles Co. wants to issue new 20-year bonds Bond Yields Giles Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,062, make semiannual payments, and mature in 20 years.

Answered: Chamberlain Co. wants to issue new… | bartleby A: Assuming Face value of bond = 100 Price of bond = 100 = Par value Coupon = Coupon Rate / 2 × Par… Q: The henderson company's bonds currently sells for $1375. They pay a $120 annual coupon and have a…

OneClass: Chamberlain Co. wants to issue new 20-year bonds for some mu Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that sell for $1,083, make semiannual payments, and mature in 20 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Show full question + 20 Watch

Answered: 9.1 percent coupon bonds on the market… | bartleby BDJ Co. wants to issue new 21-year bonds for some much-needed expansion projects. The company currently has 9.1 percent coupon bonds on the market that sell for $1,131, make semiannual payments, have a par value of $1,000, and mature in 21 years. What coupon rate should the company set on its new bonds if it wants them to sell at par?

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Chamberlain Co. wants to issue new 20-year bonds for some much-needed ... The company currently has 8.6 percent coupon bonds on the market that sell for $1,176.89, make semiannual payments, and mature in 10 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 3.10% 6.10% 6.50% 6.20% 5.90% Bond Yields [LO2] Seether Co. wants to issue new 20-year bonds needed expansion projects.

Post a Comment for "41 what coupon rate should the company set on its new bonds if it wants them to sell at par"