40 formula for coupon payment

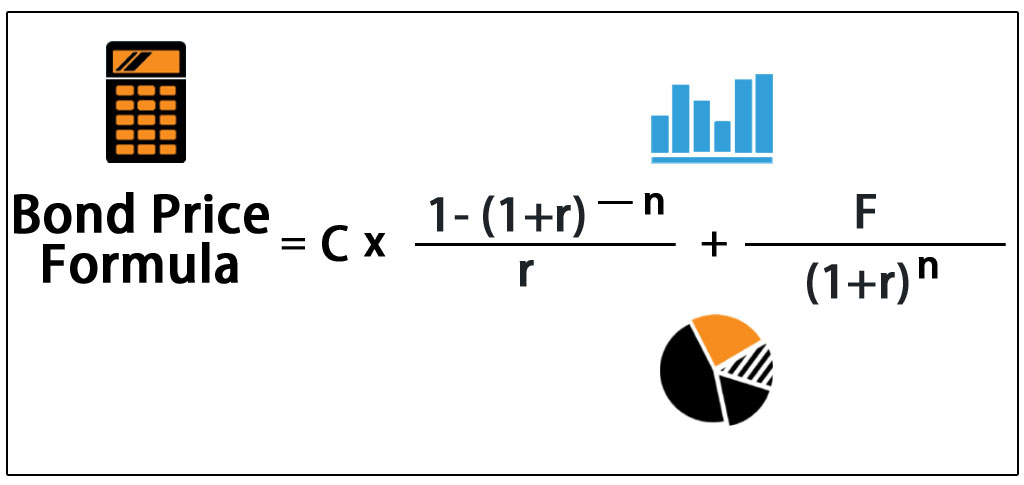

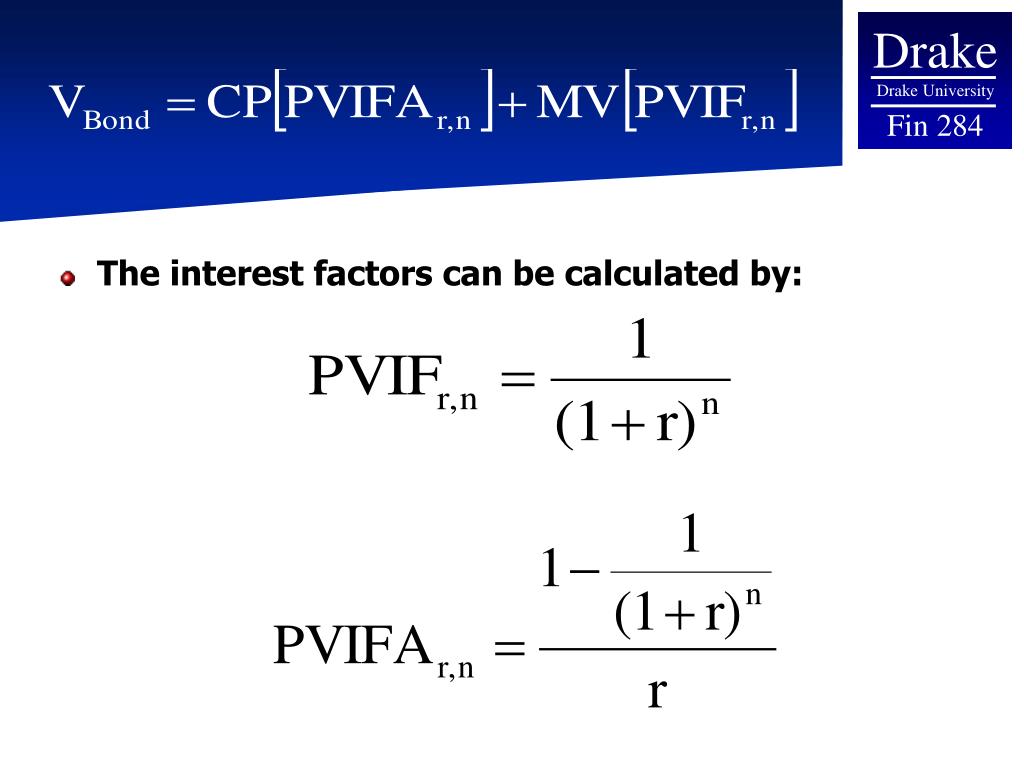

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The coupon payment is denoted by C, and it is calculated as C = Coupon rate * P / Frequency of coupon payment Next, determine the total number of periods till maturity by multiplying the frequency of the coupon payments during a year and the number of years till maturity. Coupon Rate: Definition, Formula & Calculation - Study.com Coupon Rate Formula. The formula for coupon rate is as follows: ... What is the semi-annual interest payment on a $1,000 bond with a 7% coupon rate? $70 $35 $350 $700 If a bond's value uses above ...

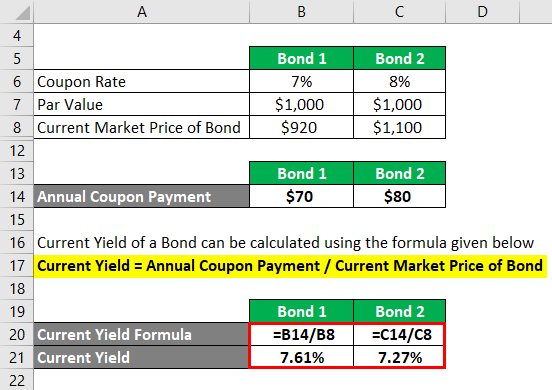

How to Calculate a Coupon Payment: 7 Steps (with Pictures) To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

Formula for coupon payment

COUPDAYS Function - Formula, Examples, How to Use The COUPDAYS function helps in calculating the number of days between a coupon period's beginning and settlement date. Formula =COUPDAYS (settlement, maturity, frequency, [basis]) The COUPDAYS function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security. Using Excel formulas to figure out payments and savings The $19,000 purchase price is listed first in the formula. The result of the PV function will be subtracted from the purchase price. The rate argument is 2.9% divided by 12. The NPER argument is 3*12 (or twelve monthly payments over three years). The PMT is -350 (you would pay $350 per month). Coupon Bond Formula | Examples with Excel Template Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Examples of Coupon Bond Formula (With Excel Template) Let's take an example to understand the calculation of Coupon Bond in a better manner.

Formula for coupon payment. Pricing bonds with different cash flows and compounding frequencies Semiannual coupon payments. Many bonds pay coupon interest semiannually. When bonds make semiannual payments, 3 adjustments to Equation 1 are necessary: (1) the number of periods is doubled; (2) the annual coupon rate is halved; (3) the annual discount rate is halved. ... then we can express the general formula for valuing a bond as follows: C ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

What is a Coupon Payment? - Definition | Meaning | Example Despite the attractive return, he decides to purchase $10,000 of the US Treasury Bond. Now, how will this affect his $10,000 principal? Using the 3% rate of return on the bond, Mark calculates that the bond's coupon payment formula, or annual payment to him, is ($10,000 x (0.03)) = $300, or $3,000 overall. Coupon Payment | Definition, Formula, Calculator & Example Formula Coupon payment for a period can be calculated using the following formula: Where F is the face value of the bond, c is the annual coupon rate and n represents the number of payments per year. Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. How to Calculate a Coupon Payment | Sapling The Coupon Rate Formula. After you've calculated the total annual coupon payment, divide this amount by the par value of the security and then multiply by 100 to convert this total to a percent. Remember the equation: coupon rate formula = (total annual coupon payment) divided by (par value of the security) x 100 percent. Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate.

How Can I Calculate a Bond's Coupon Rate in Excel? In Excel, enter the coupon payment in cell A1. In cell A2, enter the number of coupon payments you receive each year. If the bond pays interest once a year, enter 1. If you receive payments... Coupon Bond - Guide, Examples, How Coupon Bonds Work c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Thank you for reading CFI's guide on Coupon Bond. Zero-Coupon Bond: Formula and Excel Calculator If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

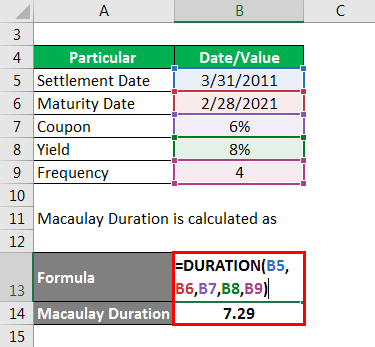

How to use the Excel COUPNUM function | Exceljet Number of coupons payable Syntax =COUPNUM (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Number of coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version

Calculating the value of the accrued coupon | Treasury Today To calculate the accrued coupon. Accrued coupon = Face value x coupon rate x number of days since last coupon Number of days in the year. A bond with a face value of £10,000,000 pays a coupon rate of 8% on a semi-annual basis (i.e. twice a year). We will calculate the accrued coupon, assuming that this bond was sold sixty-one days after the ...

COUPNCD function - support.microsoft.com The number of coupon payments per year. For annual payments, frequency = 1; for semiannual, frequency = 2; for quarterly, frequency = 4. ... Formula. Description. Result =COUPNCD(A2,A3,A4,A5) The next coupon date after the settlement date, for a bond with the above terms. 15-May-11.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

How to use the Excel COUPNCD function | Exceljet Syntax =COUPNCD (settlement, maturity, frequency, [basis]) Arguments settlement - Settlement date of the security. maturity - Maturity date of the security. frequency - Coupon payments per year (annual = 1, semi-annual = 2, quarterly = 4). basis - [optional] Day count basis (see below, default =0). Version Excel 2003 Usage notes

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%.

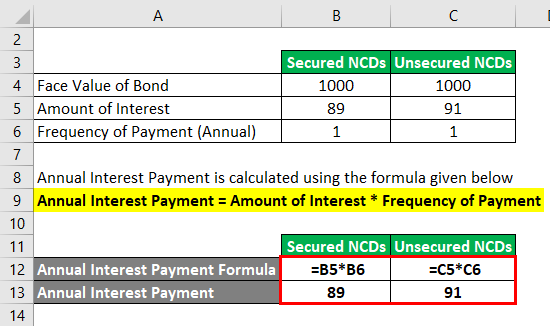

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. ... › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate % Formula: Coupon Rate = (Coupon Payment × ...

Coupon Bond Formula | Examples with Excel Template Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Examples of Coupon Bond Formula (With Excel Template) Let's take an example to understand the calculation of Coupon Bond in a better manner.

Using Excel formulas to figure out payments and savings The $19,000 purchase price is listed first in the formula. The result of the PV function will be subtracted from the purchase price. The rate argument is 2.9% divided by 12. The NPER argument is 3*12 (or twelve monthly payments over three years). The PMT is -350 (you would pay $350 per month).

COUPDAYS Function - Formula, Examples, How to Use The COUPDAYS function helps in calculating the number of days between a coupon period's beginning and settlement date. Formula =COUPDAYS (settlement, maturity, frequency, [basis]) The COUPDAYS function uses the following arguments: Settlement (required argument) - This is the settlement date of a given security.

![[SOLVED] Coupons and Taxes Problem - Joomlapolis Forum](https://www.joomlapolis.com/media/kunena/attachments/53898/2012-02-20_1144.png)

Post a Comment for "40 formula for coupon payment"